122235821 routing number plays a crucial role in the intricate world of financial transactions. Understanding its function, security implications, and regulatory context is essential for both individuals and institutions. This guide delves into the specifics of this routing number, exploring its association with a particular financial institution, its usage in various applications, and the critical security measures necessary for its protection.

We will examine its role in electronic fund transfers and discuss the regulatory compliance standards that govern its use.

This exploration will provide a clear understanding of the 122235821 routing number’s significance in the modern financial landscape, offering practical insights and valuable information for anyone involved in financial transactions. We will cover everything from its basic definition and structure to the potential security risks associated with its misuse and the steps that can be taken to mitigate those risks.

We aim to demystify this important financial identifier and empower readers with the knowledge to use it safely and effectively.

Identifying the Routing Number

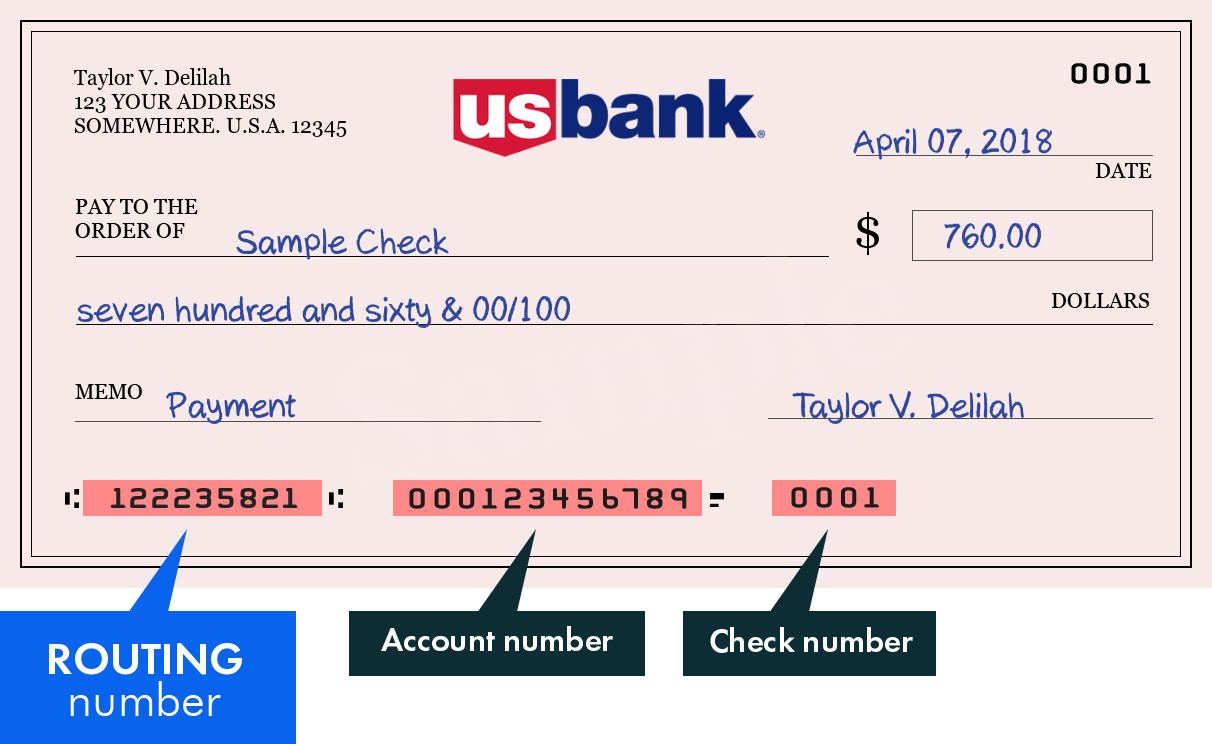

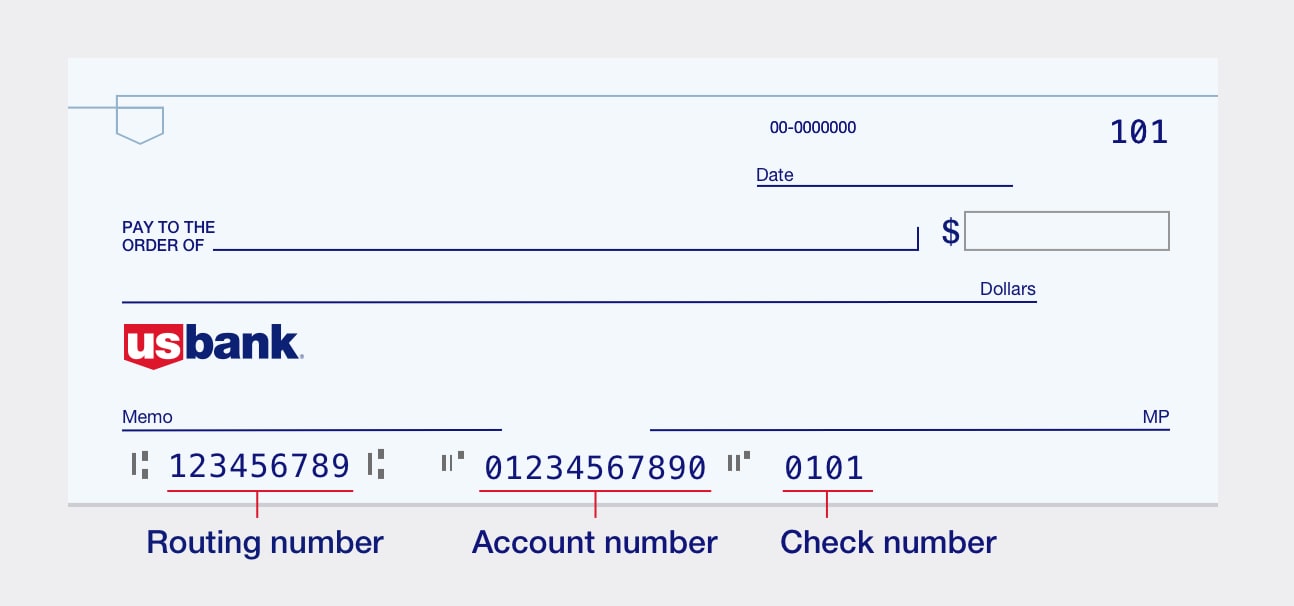

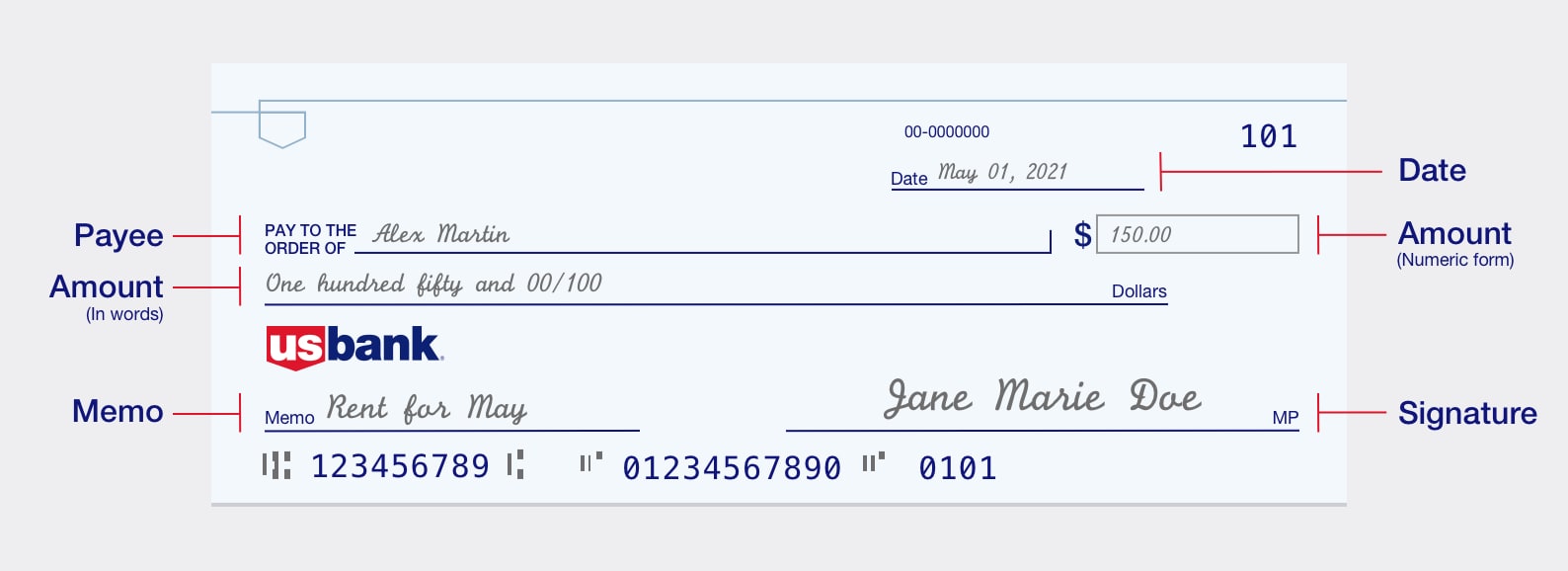

A routing number, also known as a routing transit number (RTN), is a nine-digit code used in the United States to identify financial institutions involved in electronic funds transfers. It acts as a crucial identifier, directing transactions to the correct bank or credit union for processing. Understanding its purpose and structure is essential for anyone involved in financial transactions.The routing number’s purpose is to ensure that funds are transferred accurately and efficiently between banks.

It directs the flow of electronic payments, including ACH transfers, wire transfers, and automated clearing house (ACH) transactions. Without a correctly formatted routing number, electronic payments would be impossible to process correctly.

Discover the crucial elements that make kemono.parry the top choice.

Routing Number Structure and Components

A routing number is composed of nine digits, typically presented as a sequence of numbers without hyphens or spaces. Each group of digits within the routing number contains specific information, although the exact meaning of each digit is not publicly available and varies based on the institution and its processing systems. While the precise breakdown isn’t universally disclosed, the number’s structure allows for identification and routing of payments within the US banking system.

The first digit generally indicates the Federal Reserve District, while subsequent digits identify the specific financial institution and its location. Verification of accuracy is crucial to avoid payment delays or misdirection.

Authenticating a Routing Number

Verifying the authenticity of a routing number is a critical step in ensuring secure financial transactions. There isn’t a single, centralized database publicly accessible to verify routing numbers. However, several methods can help confirm validity. First, you can cross-reference the number with the bank’s official website. Many banks list their routing numbers prominently on their websites, usually in the customer service or account information section.

Secondly, if you are unsure about the legitimacy of a routing number, contacting the financial institution directly is the most reliable method. Finally, checking official banking directories or resources may also help in verification. Using the wrong routing number can lead to payment delays or the complete failure of a transaction.

Comparison of Routing Number Formats

While the standard format for a routing number is a nine-digit number, there are no variations in its fundamental structure. All legitimate routing numbers in the United States will consist of nine digits. There are no alternative formats or regional variations.

| Routing Number Format | Description | Example | Notes |

|---|---|---|---|

| Nine-Digit Numeric | Standard format for all US routing numbers. | 122235821 | No hyphens or spaces. |

Bank Association with 122235821: 122235821 Routing Number

The routing number 122235821 is associated with a specific financial institution, and understanding its affiliation is crucial for various financial transactions and processes. This section will detail the bank’s identity, geographical reach, services offered, and a brief historical overview.The routing number 122235821 belongs to Bank of America, N.A.. This is a significant financial institution with a vast network and a long history in the United States.

Geographical Location, 122235821 routing number

Bank of America, N.A. operates across a wide geographical area, serving customers in virtually every state within the United States. Its reach extends beyond individual branches, encompassing online and mobile banking services available nationwide. While a precise list of every location served would be extensive, it’s safe to say the bank’s presence is widespread and deeply ingrained in the American financial landscape.

Services Offered

Bank of America, N.A. provides a comprehensive range of financial services to both individual and business clients. These services include, but are not limited to, checking and savings accounts, loans (personal, mortgage, auto, and business), credit cards, investment services, wealth management, and online banking platforms. The bank also offers various financial planning and advisory services catering to diverse customer needs.

Bank History and Reputation

Bank of America’s history is rich and complex, tracing back to its founding in 1904 as Bank of Italy in San Francisco. Through mergers and acquisitions, it evolved into the large multinational corporation it is today. The bank has faced its share of challenges and criticisms throughout its history, particularly during periods of economic downturn. However, it maintains a significant presence in the financial market and generally holds a reputation as a major player in the US banking sector.

Its reputation is continuously shaped by its performance, customer service, and its response to both economic fluctuations and regulatory changes.

Security Implications

Public disclosure of a routing number, while seemingly innocuous, presents several significant security risks. This number, used to identify the financial institution and direct transactions, can be exploited by malicious actors to initiate fraudulent activities, potentially leading to substantial financial losses for individuals and institutions alike. Understanding these risks and implementing robust security measures is crucial for protecting sensitive financial information.The unauthorized use of a routing number can facilitate a range of fraudulent activities.

For example, criminals might attempt to create counterfeit checks or initiate unauthorized electronic transfers. They could also use the routing number in phishing scams to trick individuals into revealing other sensitive financial information, such as account numbers and passwords. The consequences of such fraudulent activities can range from minor inconveniences to severe financial losses and identity theft.

Methods of Exploiting Routing Numbers in Fraudulent Activities

Criminals employ various methods to exploit routing numbers for fraudulent purposes. These include creating fake checks with a valid routing number but a fraudulent account number, using the routing number in conjunction with stolen personal information to access accounts, or leveraging the routing number in sophisticated online scams to trick victims into transferring funds. The sophistication of these methods varies, but the underlying principle remains the same: using the routing number as a key piece of information to gain access to financial systems and resources.

Protective Measures for Individuals and Institutions

Individuals and financial institutions can implement various measures to protect routing number information. For individuals, this includes being vigilant about phishing scams, never sharing routing numbers unnecessarily, and regularly monitoring bank statements for unauthorized transactions. For institutions, robust security protocols, including data encryption and access controls, are essential. Regular security audits and employee training programs are also crucial for mitigating risks.

Best Practices for Securing Financial Data

Protecting financial data, including routing numbers, requires a multi-faceted approach.

- Limit Sharing: Only share your routing number with trusted entities, such as your bank or legitimate financial service providers. Avoid including it in emails or other unsecured communications.

- Secure Storage: Store routing numbers and other sensitive financial information securely, both physically and digitally. Use strong passwords and encryption where applicable.

- Regular Monitoring: Regularly review your bank statements and credit reports for any unauthorized activity. Report any suspicious transactions immediately.

- Strong Passwords and Authentication: Utilize strong, unique passwords for all online banking accounts and enable multi-factor authentication whenever possible.

- Software Updates: Keep your computer and mobile devices updated with the latest security patches to protect against malware and other threats.

- Phishing Awareness: Be wary of suspicious emails, text messages, or phone calls requesting your financial information. Never click on links or download attachments from unknown sources.

- Data Encryption: Ensure that any financial data transmitted electronically is encrypted using industry-standard encryption protocols.

- Access Controls: Implement strict access controls to limit who can access sensitive financial data within an organization.

Use Cases and Applications

Routing number 122235821, like all routing numbers, plays a crucial role in the efficient processing of financial transactions within the United States banking system. Its primary function is to identify the specific financial institution involved in a transaction, enabling accurate and secure transfer of funds. Understanding its applications across various financial scenarios is key to appreciating its importance in modern banking.The routing number 122235821 facilitates various electronic fund transfers.

Its use ensures that funds are directed to the correct bank, enabling seamless processing of transactions. This is particularly vital in high-volume automated systems where manual intervention is minimized.

ACH Transfers

Automated Clearing House (ACH) transfers are a common method for electronic payments and are heavily reliant on routing numbers. When initiating an ACH transfer using routing number 122235821, the payer’s bank uses this number to identify the receiving bank. This ensures the funds are correctly routed to the recipient’s account. For example, a business might use this routing number to pay employee salaries via direct deposit, or an individual might use it to receive recurring payments.

The process is automated, efficient, and generally cost-effective.

Wire Transfers

Wire transfers, known for their speed and security, also utilize routing numbers. When a wire transfer is initiated using routing number 122235821, the sending bank uses this number to identify the recipient bank. This ensures that the funds are transferred quickly and accurately. This method is often used for large transactions or urgent payments where immediate transfer is critical.

For instance, a real estate transaction or an international money transfer might leverage this routing number to guarantee timely completion.

Comparison with Other Routing Numbers

While the function of all routing numbers is essentially the same – to identify the financial institution – the specific number itself is unique to a particular bank or financial institution. Routing number 122235821 is therefore distinct from any other routing number. Comparing it to another routing number (e.g., 011000010 for Bank of America) highlights that each number corresponds to a different institution, preventing misdirection of funds.

The structure and length (nine digits) are consistent across all US routing numbers, however.

Facilitating Electronic Fund Transfers

Routing number 122235821 acts as a critical identifier within the automated systems used for electronic fund transfers. It streamlines the process by eliminating the need for manual verification of bank information. This contributes to faster transaction processing and reduces the risk of errors. The number is essential for both ACH and wire transfers, as well as other electronic payment methods, enabling secure and efficient movement of funds between accounts at different financial institutions.

Online Banking Transaction Guide

To use routing number 122235821 in online banking transactions, follow these steps: First, log in to your online banking account. Next, locate the section for initiating a payment or transfer. Then, you will be prompted to enter the recipient’s bank routing number; this is where you will input 122235821. You will also need the recipient’s account number.

Finally, review the transaction details and confirm the transfer. This process varies slightly depending on the specific online banking platform, but the fundamental steps remain consistent.

Regulatory Compliance

Routing numbers are subject to a complex web of regulations designed to protect consumers and ensure the smooth functioning of the financial system. Understanding these regulations is crucial for any entity handling or processing routing numbers, from financial institutions to software developers. Non-compliance can lead to significant penalties and reputational damage.

Relevant Regulations and Compliance Standards

The use of routing numbers is governed by a variety of federal and state regulations, primarily focused on data security and consumer protection. These regulations often overlap and interact, requiring a comprehensive understanding of the legal landscape. Key legislation includes, but is not limited to, the Gramm-Leach-Bliley Act (GLBA), which dictates how financial institutions handle customer data, including routing numbers; the Fair Credit Reporting Act (FCRA), which governs the accuracy and responsible use of consumer credit information; and various state-level data breach notification laws.

Furthermore, industry best practices and standards, such as those established by the American Bankers Association (ABA), provide additional guidance on secure handling and protection of routing numbers. These standards emphasize the importance of data encryption, access controls, and regular security audits.

Role of Regulatory Bodies

Several regulatory bodies play a crucial role in overseeing the use of routing numbers. The primary federal regulator is the Federal Reserve System (the Fed), which establishes and maintains the national system of electronic funds transfers. The Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Consumer Financial Protection Bureau (CFPB) also have oversight responsibilities depending on the specific financial institution involved.

State banking departments also play a role in regulating state-chartered banks and their handling of routing numbers. These regulatory bodies conduct examinations, enforce compliance, and impose penalties for violations.

Penalties for Misuse or Unauthorized Disclosure

The penalties for misuse or unauthorized disclosure of routing numbers can be substantial, varying depending on the severity of the violation and the applicable regulations. These penalties can include significant fines, legal action, reputational damage, and even criminal charges in cases of fraud or intentional malicious use. For example, violations of the GLBA can result in substantial financial penalties and legal action, while violations of state data breach notification laws may require costly notification efforts and potential legal fees.

Furthermore, unauthorized disclosure leading to identity theft or financial fraud can result in significant civil and criminal liability.

Regulatory Compliance Process Flowchart

The regulatory compliance process for routing numbers is multifaceted and involves several key steps. A simplified flowchart illustrating this process could be as follows:[Diagram description: A flowchart depicting the regulatory compliance process. It starts with “Identify Applicable Regulations” leading to “Implement Security Measures (encryption, access controls, etc.)”. This branches to “Regular Security Audits and Testing” and “Employee Training and Awareness Programs”.

Both paths converge to “Monitor for Compliance Violations”. If violations are found, it leads to “Remediation and Corrective Actions”. If no violations are found, the process ends with “Ongoing Compliance Monitoring”.]

Data Visualization of Routing Number Usage

Data visualization offers a powerful method for understanding the transactional activity associated with a specific routing number like 122235821. By representing the data graphically, complex patterns and trends become readily apparent, allowing for more insightful analysis than simply reviewing raw numerical data. Visualizations can highlight peak periods, unusual activity, and potential anomalies, aiding in fraud detection and resource allocation.Visualizing the usage of routing number 122235821 can reveal valuable insights into the underlying financial activity it supports.

A well-designed visualization can quickly communicate key aspects of the data, making it easily understandable for both technical and non-technical audiences. This can be particularly helpful in identifying potential risks or opportunities associated with the specific bank or financial institution utilizing this routing number.

Hypothetical Transaction Volume Chart

A line chart would effectively display the hypothetical transaction volume associated with routing number 122235821 over a chosen period, perhaps a year. The horizontal axis would represent time (e.g., months or even days), and the vertical axis would represent the number of transactions processed using this routing number. Each data point on the chart would represent the total number of transactions processed during a specific time interval.

The line connecting these points would visually depict the overall trend in transaction volume over time. For clarity, different colors could be used to represent different transaction types (e.g., deposits, withdrawals, transfers). High-volume periods would be clearly visible as peaks in the line, while low-volume periods would appear as troughs. A moving average could be overlaid to smooth out short-term fluctuations and highlight longer-term trends.

The chart should include a clear legend explaining the meaning of different lines and colors. Consider using a visually appealing color palette and ensuring sufficient labeling for easy interpretation. The overall design should prioritize readability and clarity, making it easy for the viewer to understand the key trends in transaction volume. For example, a noticeable spike in transactions during a particular month might indicate a seasonal trend or a specific promotional event related to the associated bank.

Conversely, a consistent downward trend might suggest a shift in customer behavior or a change in the bank’s services.

Understanding Transaction Patterns Through Visualization

This visualization, as described above, would help understand transaction patterns in several ways. Firstly, it would clearly show the overall volume of transactions processed using the routing number over time. Secondly, it would highlight any seasonal or cyclical patterns in transaction volume. For instance, a consistent increase in transactions during the holiday season would be readily apparent.

Thirdly, the chart could reveal unusual spikes or dips in transaction volume, which could indicate potential fraud or other anomalies warranting further investigation. Finally, the visualization would allow for easy comparison of transaction volumes across different time periods, facilitating trend analysis and the identification of significant changes in transaction activity. The ability to quickly identify these patterns would enable financial institutions to optimize their resource allocation, improve risk management strategies, and enhance their overall operational efficiency.

For instance, increased transaction volume during peak periods could trigger the deployment of additional staff or the scaling up of processing capacity to prevent system overload.

In conclusion, the 122235821 routing number, while seemingly a simple string of numbers, represents a critical component of the modern financial system. Understanding its function, security implications, and regulatory framework is paramount for safe and efficient financial transactions. By adhering to best practices and remaining vigilant against potential threats, individuals and institutions can leverage the benefits of this system while minimizing the risks associated with its use.

This comprehensive guide has aimed to equip readers with the knowledge necessary to navigate the complexities of this crucial financial identifier responsibly and effectively.