TD Bank routing numbers are essential for seamless banking transactions. Understanding their purpose, location, and proper usage is crucial for avoiding delays and potential financial complications. This guide provides a comprehensive overview of TD Bank routing numbers, covering everything from finding your number to ensuring its secure use in various transactions.

We will explore the different types of TD Bank routing numbers, their applications in various transaction types (like wire transfers and bill payments), and the security measures you should take to protect this sensitive information. We’ll also address common issues and provide troubleshooting steps to ensure smooth banking experiences.

Understanding TD Bank Routing Numbers

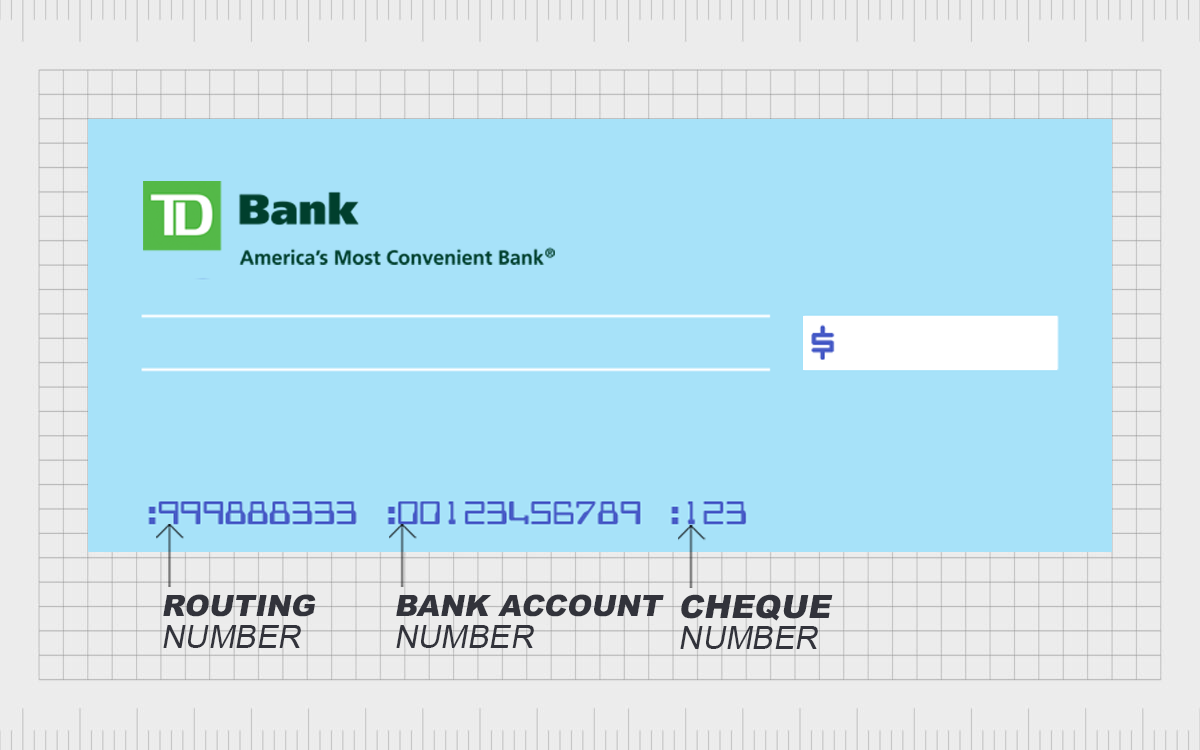

A TD Bank routing number is a nine-digit code that identifies the specific financial institution – in this case, TD Bank – involved in a banking transaction. Understanding its purpose and usage is crucial for smooth and accurate money transfers. This information will clarify the different types of TD Bank routing numbers and provide examples of when you’ll need to use them.

Obtain access to 122235821 routing number to private resources that are additional.

The Purpose of a Routing Number

Routing numbers are essential for directing electronic funds transfers between banks. They act as a unique identifier, ensuring that your money reaches the correct recipient’s account at the correct bank. Without a routing number, electronic transactions like direct deposits, wire transfers, and automated clearing house (ACH) payments wouldn’t be possible. The routing number guides the transaction through the complex network of financial institutions.

Types of TD Bank Routing Numbers and Their Uses

TD Bank, like many large financial institutions, may have multiple routing numbers. This is often due to acquisitions or the bank’s presence in different states or regions. Each routing number is specific to a particular branch or processing center. While the specific number of routing numbers and their geographical association is not publicly listed in a readily accessible format, it’s crucial to use the correct number for your specific account.

Incorrect use can lead to delays or failed transactions. It’s advisable to always confirm the correct routing number with your TD Bank statement or by contacting customer service.

Examples of When a TD Bank Routing Number is Required

A TD Bank routing number is necessary for several common banking transactions:

- Setting up direct deposit for your paycheck or government benefits.

- Making electronic payments to vendors or individuals.

- Initiating wire transfers.

- Automating bill payments.

- Receiving funds from another bank account via ACH transfer.

Providing the incorrect routing number can result in significant delays and complications, so it is important to double-check its accuracy before initiating any transactions.

Definition of a TD Bank Routing Number for a FAQ Section

A TD Bank routing number is a nine-digit code that identifies the specific TD Bank branch or processing center involved in electronic funds transfers. It’s essential for accurate and efficient processing of transactions like direct deposits, wire transfers, and online payments.

Infographic: The Function of a Routing Number

The infographic would visually represent the flow of money between two accounts at different banks. A large box representing “Sender’s Bank” would be connected by a thick arrow labeled “Routing Number” to a large box representing “Recipient’s Bank”. Smaller boxes within each bank would represent individual accounts. The arrow would visually emphasize the routing number’s role in directing the funds to the correct recipient’s account.

The nine-digit routing number would be prominently displayed on the arrow, along with a brief explanation of its purpose. The infographic would use clear, concise language and a visually appealing design to effectively communicate the concept.

Using TD Bank Routing Numbers for Different Transactions

Understanding how TD Bank routing numbers function in various transactions is crucial for ensuring smooth and accurate financial processes. This section will detail the use of routing numbers in different transaction types, highlighting key information needed and potential consequences of errors.

Routing Numbers in Different Transaction Types

TD Bank routing numbers are essential identifiers used by financial institutions to process transactions between banks. Their correct use is vital for the successful completion of various financial activities. The application of the routing number varies slightly depending on the transaction type.

Wire Transfers, Td bank routing number

Wire transfers are typically used for large, urgent transactions. When initiating a wire transfer, you will need to provide the recipient’s bank’s routing number, the recipient’s account number, and the recipient’s full name and address. The sender’s account information, including their account number and routing number, will also be required. For example, to send a wire transfer from your TD Bank account, you’ll provide your TD Bank routing number along with your account number, and the recipient’s bank’s routing number and their account details.

An incorrect routing number will result in the wire transfer being delayed or failing entirely, potentially leading to significant financial and time-related consequences.

ACH Transfers

Automated Clearing House (ACH) transfers are used for electronic payments and transfers, such as direct deposits and bill payments. Similar to wire transfers, you will need the recipient’s bank’s routing number and account number. The routing number directs the payment to the correct bank, while the account number identifies the specific recipient’s account. Incorrectly entering the routing number in an ACH transfer could lead to the payment being sent to the wrong account or rejected entirely, delaying payments and potentially causing financial repercussions for both the sender and the recipient.

For example, setting up automatic payments for a bill, ensuring the correct routing and account numbers are used is paramount.

Bill Payments

When paying bills electronically, the routing number identifies your bank to the payee’s financial institution. The bill payer must provide their account number and routing number to the biller. The payee then uses this information to debit the correct account. Entering an incorrect routing number will result in the bill payment being rejected, potentially incurring late payment fees or damaging your credit score.

For example, when paying your mortgage online, ensure that the correct routing number for your TD Bank account is entered to avoid payment delays.

Consequences of Errors

Errors in entering a routing number can lead to significant problems, including delayed or failed transactions, financial losses, and damaged credit scores. In some cases, recovering funds from an incorrectly routed transaction can be a lengthy and complex process.

Additional Required Information

Beyond the routing number, several other pieces of information are necessary for successful transactions. These typically include the account number, the recipient’s name and address, and the amount of the transaction. For international transactions, additional information such as SWIFT codes might also be needed.

Transaction Information Summary

| Transaction Type | Routing Number | Account Number | Other Required Information |

|---|---|---|---|

| Wire Transfer | Required | Required | Recipient’s name, address, and bank details |

| ACH Transfer | Required | Required | Recipient’s name (often) |

| Bill Payment | Required | Required | Payee’s information, amount |

Troubleshooting Issues with TD Bank Routing Numbers

Using the correct routing number is crucial for ensuring your financial transactions are processed smoothly and accurately. Incorrect routing numbers can lead to delays, failed transactions, and even potential security concerns. This section will guide you through common problems and their solutions.

Common Problems with TD Bank Routing Numbers

Several issues can arise when using your TD Bank routing number. These often stem from simple errors, but understanding these potential pitfalls allows for quicker resolution. For instance, mistyping the number is a frequent occurrence, leading to immediate transaction failure. Another common problem involves using an outdated routing number, especially if you’ve recently changed banks or accounts.

Finally, security concerns, such as the suspicion of compromised routing number information, require immediate attention and proactive measures.

Solutions for Resolving Routing Number Issues

The first step in resolving any issue is to double-check the accuracy of the routing number itself. Compare it carefully to the number printed on your checks or available through online banking. If a typo is suspected, re-enter the number meticulously. If you’ve recently changed banks or accounts, ensure you are using the correct, updated routing number for your current TD Bank account.

Contacting TD Bank customer service directly is advisable if you are still facing problems after verifying the number’s accuracy. They can confirm the correct routing number associated with your account and assist with any related issues.

Handling Transactions Failing Due to Incorrect Routing Numbers

If a transaction fails due to an incorrect routing number, the first step is to identify the source of the error. Was the number entered incorrectly? Is it the correct number for the intended account? Once the error is identified, correct the routing number and resubmit the transaction. If the problem persists, contact the recipient of the funds (the payee) or the institution processing the transaction (e.g., your bank or the recipient’s bank) to investigate further.

They may be able to provide additional details or assistance in resolving the issue.

Steps to Take if a Routing Number is Suspected to be Compromised

If you suspect your routing number has been compromised, immediate action is necessary to mitigate potential financial losses. First, contact TD Bank immediately to report the suspected compromise. They will guide you through the necessary steps, which may include freezing your account, opening a new account, and filing a fraud report. Monitor your account statements closely for any unauthorized activity.

Change your online banking password and any other relevant passwords to enhance your overall online security. Consider placing fraud alerts on your credit reports as an added precaution.

Troubleshooting Flowchart for Routing Number Issues

The following describes a flowchart illustrating the troubleshooting process. The flowchart begins with identifying the problem: a failed transaction or suspicion of compromise. If a failed transaction is the issue, verify the routing number. If correct, investigate other potential causes (e.g., insufficient funds). If incorrect, correct the number and retry the transaction.

If the transaction still fails, contact TD Bank customer service. If a compromised routing number is suspected, immediately contact TD Bank and follow their security protocols. This process involves a series of decision points, leading to appropriate resolutions for various scenarios. The flowchart visualizes this step-by-step approach, guiding users to the correct solution based on the specific issue encountered.

Successfully navigating the world of TD Bank routing numbers requires awareness and vigilance. By understanding their purpose, securely locating your number, and using it correctly in various transactions, you can ensure the efficient and safe processing of your financial activities. Remember to always prioritize the security of your routing number and contact TD Bank directly if you encounter any issues.