Truist Bank near me – finding the closest branch is easier than you think! This guide explores various methods for locating Truist Bank branches, comparing services offered at different locations, and examining customer experiences. We’ll delve into the convenience of online search tools, the specifics of services available, and even compare Truist to its competitors to help you make an informed decision about your banking needs.

Whether you need quick access to an ATM, require personalized financial advice, or are simply curious about the services offered at your local Truist branch, this comprehensive guide will equip you with the information you need. We’ll cover everything from using GPS to locate the nearest branch to understanding the nuances of different branch types and service offerings. By the end, you’ll be confident in your ability to find and utilize the Truist Bank branch that best suits your requirements.

Truist Bank Location Search Functionality

Finding the nearest Truist Bank branch should be a seamless and intuitive process, regardless of whether a customer uses the mobile app or an online search engine. This section details the functionality and user experience related to locating Truist Bank branches. We will cover the design of a mobile app search feature, a step-by-step guide for online searches, and examples of potential error messages and their solutions.

Do not overlook explore the latest data about wise county messenger.

Efficient location search is crucial for providing excellent customer service and ensuring accessibility to Truist Bank’s services. A well-designed system minimizes frustration and enhances the overall customer experience.

Mobile App User Interface for Branch Location Search

The Truist mobile banking app should incorporate a map-based location search feature. Upon launching the feature, the app should automatically obtain the user’s location via GPS. A visually appealing map, potentially using a provider like Google Maps or Apple Maps, will display the user’s current location with a marker. Nearby Truist Bank branches will be shown as additional markers on the map, each clearly labeled with the branch name and address.

Users should be able to zoom in and out of the map, and tap on individual branch markers to reveal a detailed information panel. This panel should display the branch’s full address, phone number, hours of operation, and potentially services offered. The app could also offer options such as directions (using the device’s built-in map application), saving a favorite branch, or viewing the branch’s details in a list view.

Locating a Truist Bank Branch Using Online Search Engines

Finding a Truist Bank branch using online search engines requires a strategic approach to formulating search queries. The effectiveness of the search depends heavily on the s used.

- Search Query Variations: Users should experiment with different search phrases to maximize their chances of finding relevant results. Examples include: “Truist Bank near me,” “Truist Bank locations,” “Truist Bank [city name],” “Truist Bank [zip code],” or “Truist branches [state].” More specific searches, such as “Truist Bank ATM [address]”, can also be useful.

- Using Google Maps: Google Maps is a highly effective tool. Typing “Truist Bank” into the search bar, followed by a location qualifier, will yield results directly on the map. This provides a visual representation of branch locations and allows users to easily assess proximity and directions.

- Truist Website Search: The official Truist website should have a dedicated branch locator tool. This tool might use either a map or a searchable list of branches. Utilizing this option ensures accurate and up-to-date information.

Examples of Error Messages and Solutions

Users might encounter several error messages during their search for a Truist Bank location. Understanding these messages and their potential causes is crucial for providing effective solutions.

| Error Message | Possible Cause | Solution |

|---|---|---|

| “No Truist Bank locations found near your current location.” | The user’s GPS is disabled or inaccurate, or there are no Truist branches within a reasonable radius. | Enable GPS location services on the device. Try a broader search, using less specific location criteria (e.g., city instead of zip code). |

| “Network error. Please check your internet connection.” | The device is not connected to the internet or the connection is unstable. | Ensure a stable internet connection is established on the device. |

| “Server error. Please try again later.” | A temporary issue with Truist’s servers is preventing the search from completing. | Try the search again after a short period. If the problem persists, contact Truist customer support. |

| “Location services are unavailable.” | The device’s location services are disabled or encountering an issue. | Check device settings and ensure location services are enabled and set to the appropriate accuracy level. |

Services Offered at Nearby Truist Bank Branches: Truist Bank Near Me

Truist Bank offers a comprehensive range of financial services designed to meet the needs of both individuals and businesses. The specific services available may vary depending on the size and type of branch, but most locations provide a core set of options across personal, business, and wealth management areas. Understanding these variations is key to choosing the most convenient and suitable branch for your specific banking needs.

The services offered at Truist Bank branches are diverse and cater to a wide spectrum of financial requirements. Branch locations range from full-service branches with extensive offerings to smaller offices providing more limited services. This variation influences both the types of services available and the hours of operation.

Personal Banking Services, Truist bank near me

Truist Bank’s personal banking services are designed to simplify daily financial management. These typically include checking and savings accounts, debit and credit cards, online and mobile banking, and various loan options. Full-service branches often offer additional services like financial consultations and assistance with setting up retirement accounts. Smaller offices might focus primarily on account management and basic transactions.

Business Banking Services

For businesses, Truist Bank provides a suite of services to support growth and financial stability. These can range from business checking and savings accounts to commercial loans, lines of credit, and merchant services. Larger branches often have dedicated business banking specialists who can provide tailored advice and support. Smaller locations may offer a more limited selection of business services, potentially directing clients to larger branches for more complex needs.

Wealth Management Services

Truist Bank’s wealth management services are geared towards individuals and families seeking comprehensive financial planning and investment solutions. These services typically include investment management, financial planning, retirement planning, and trust and estate services. Access to wealth management services is generally concentrated in larger, full-service branches. Smaller branches may offer limited introductory services or direct clients to specialized wealth management offices.

Variations in Services Across Branch Types

The range of services available significantly differs between full-service branches and smaller offices. Full-service branches typically offer a complete suite of personal, business, and wealth management services, including specialized consultations and support. Smaller offices, often located in less densely populated areas, generally focus on basic transactions and account management. They may have limited staff and fewer resources, directing clients to larger branches for more complex needs.

Branch Hours of Operation

Truist Bank branch hours vary depending on location and day of the week. Full-service branches in major urban centers typically have extended hours, often including weekend availability. Smaller offices in less populated areas generally operate during standard business hours, Monday through Friday, and may be closed on weekends. It’s crucial to check the specific hours of operation for your chosen branch before visiting, using online branch locators or contacting the bank directly.

For instance, a branch in a bustling city center might operate from 8:00 AM to 7:00 PM on weekdays and 9:00 AM to 1:00 PM on Saturdays, while a smaller branch in a rural area might operate from 9:00 AM to 5:00 PM, Monday to Friday only.

Comparison with Competitor Banks

Choosing the right bank involves considering various factors beyond just proximity. A comparison with competitor banks helps determine which institution best suits individual needs and preferences. This section will analyze Truist Bank’s performance against other major players, focusing on factors relevant to a “near me” search.

Understanding the differences between Truist Bank and its competitors is crucial for making an informed decision. This comparison will highlight key aspects such as ATM network reach, branch density, online banking features, and customer service, ultimately assisting in selecting the bank that best meets your specific requirements.

ATM Network Coverage Comparison

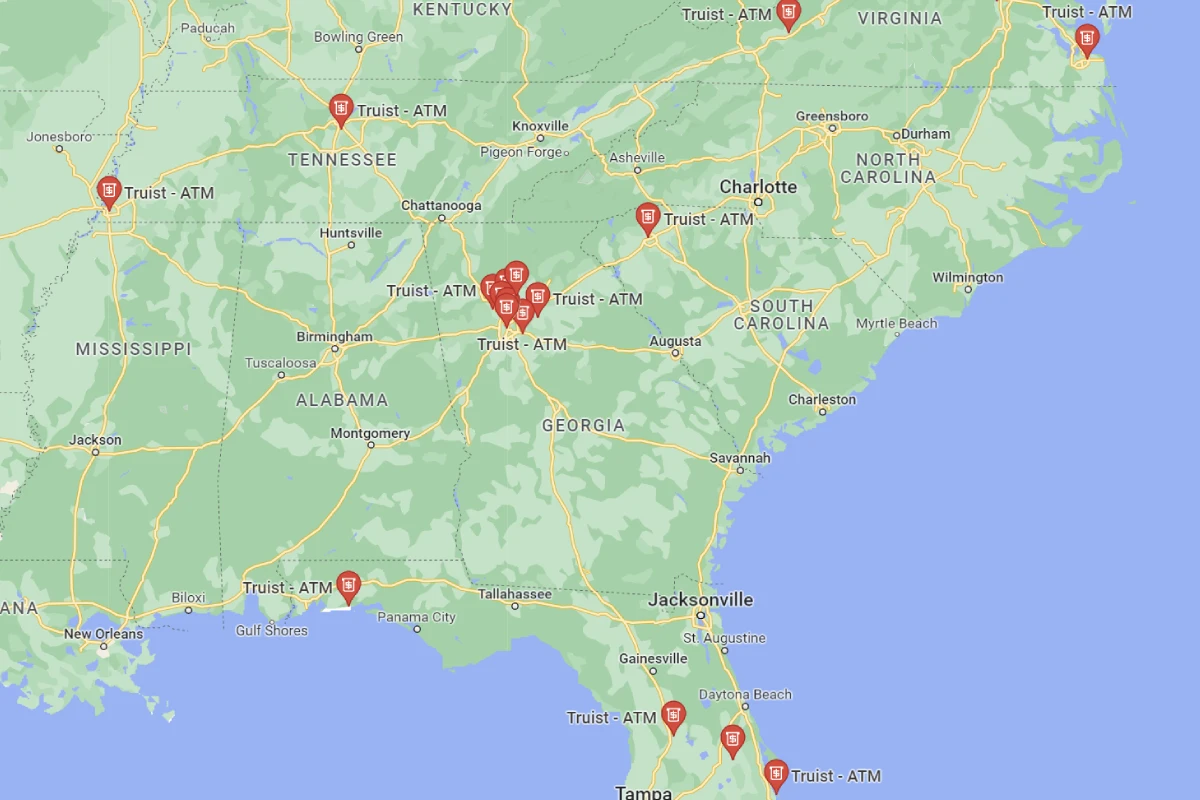

Access to readily available ATMs is a critical factor for many banking customers. The following comparison illustrates the ATM network coverage of Truist Bank against two major competitors—Bank of America and Wells Fargo—within a hypothetical region such as the Southeast United States. Note that actual coverage can vary depending on the specific location.

- Truist Bank: Extensive network within the Southeast, particularly strong in North Carolina, South Carolina, and Georgia. May have fewer ATMs in more rural areas compared to its competitors.

- Bank of America: Generally considered to have a wider ATM network across the Southeast, with a greater presence in urban areas and a strong nationwide network.

- Wells Fargo: Similar to Bank of America, boasts a substantial ATM network across the Southeast, offering convenient access in both urban and suburban locations.

Advantages and Disadvantages Compared to Competitors

While ATM network coverage is important, several other factors contribute to the overall banking experience. This section highlights the advantages and disadvantages of Truist Bank relative to its competitors, emphasizing aspects relevant to a “near me” search.

- Advantage: Branch Density (in certain areas): Truist Bank might have a higher concentration of branches in specific regions compared to competitors, offering more convenient in-person banking options for those who prefer this method.

- Disadvantage: Branch Density (in other areas): Conversely, in certain areas, Truist Bank’s branch network might be less extensive than that of Bank of America or Wells Fargo, potentially limiting access for some customers.

- Advantage: Online Banking Features: Truist Bank’s online and mobile banking platforms offer a range of features, including bill pay, mobile check deposit, and account management tools, comparable to its competitors.

- Disadvantage: Customer Service: While customer service experiences vary, some users might find the customer service provided by Truist Bank to be less responsive or efficient compared to competitors. This is subjective and depends on individual experiences.

Choosing Between Banks Based on Location, Services, and Customer Reviews

The decision of which bank to choose often comes down to a careful weighing of location convenience, the specific services needed, and the overall customer experience reported by other users. Consider the following points.

A user living in a densely populated area with many branches of all three banks might prioritize customer reviews and online banking features. If reviews suggest consistently faster and more helpful customer service from Bank of America, that might be the deciding factor. Conversely, a user in a rural area with limited branch access might prioritize the bank with the most extensive ATM network, even if online features are slightly less advanced.

Finally, a user focused on specific financial products or services (e.g., specialized investment options) would prioritize the bank offering those specific services, regardless of location or ATM access.

Locating the perfect Truist Bank branch to meet your banking needs is now simplified. This guide has provided you with multiple avenues to search for nearby branches, understand the services offered, and compare them to competitors. Remember to utilize online resources, explore customer reviews, and consider factors like branch type and location to make the best choice for your individual circumstances.

We hope this information empowers you to make informed banking decisions and enjoy a positive experience with Truist Bank.