Zillow Dallas provides a comprehensive look into the dynamic Dallas real estate market. This exploration delves into Zillow’s influence on property searches, price perceptions, and the overall buying and selling process. We’ll examine the accuracy of Zillow’s Zestimates, compare Dallas’s market to other Texas cities, and highlight popular neighborhoods featured on the platform. This analysis aims to provide both homebuyers and investors with valuable insights into navigating the Dallas real estate landscape using Zillow’s data effectively.

From understanding average prices per square foot across various Dallas neighborhoods to analyzing the distribution of property types listed on Zillow, we’ll uncover key trends and patterns. We’ll also discuss how real estate professionals leverage Zillow’s data and explore potential investment opportunities based on the information provided. Ultimately, this guide aims to empower readers with the knowledge necessary to confidently use Zillow as a tool for their Dallas real estate endeavors.

Zillow’s Role in the Dallas Market

Zillow has significantly impacted the Dallas real estate market, influencing how potential homebuyers search for properties and perceive home values. Its widespread use has created a dynamic interplay between online search behavior, pricing expectations, and the actions of both buyers and real estate professionals. Understanding Zillow’s role is crucial for navigating the Dallas housing market effectively.Zillow’s Influence on Home Searches and Pricing Perceptions in DallasZillow’s extensive database and user-friendly interface have made it the go-to platform for many Dallas residents initiating their home search.

The ease of filtering properties based on various criteria (price range, square footage, number of bedrooms, etc.) empowers users to quickly narrow their options. However, this convenience also introduces the potential for skewed perceptions of market value, as Zillow’s Zestimate, while helpful, is not a definitive appraisal. Many users rely heavily on the Zestimate, potentially leading to unrealistic expectations regarding offer prices or the perceived value of their own homes.

This influence is particularly notable in a competitive market like Dallas, where accurate price perception is vital.

Zestimate Accuracy in Dallas, Zillow dallas

The accuracy of Zillow’s Zestimates in Dallas, like in other markets, varies. While Zillow uses a proprietary algorithm incorporating various data points, including recent sales, property characteristics, and market trends, it’s essential to understand that Zestimates are not appraisals. They serve as estimates, and their accuracy can be significantly affected by factors such as unique property features, recent market fluctuations, and data lag.

For example, a newly renovated home might not be accurately reflected in the Zestimate immediately, leading to a potential underestimation. Conversely, a property in a rapidly appreciating neighborhood might be underestimated if the Zestimate algorithm hasn’t fully caught up with the recent price increases. It’s crucial for both buyers and sellers to rely on professional appraisals for accurate valuations.

Zillow Data Usage by Dallas Real Estate Professionals

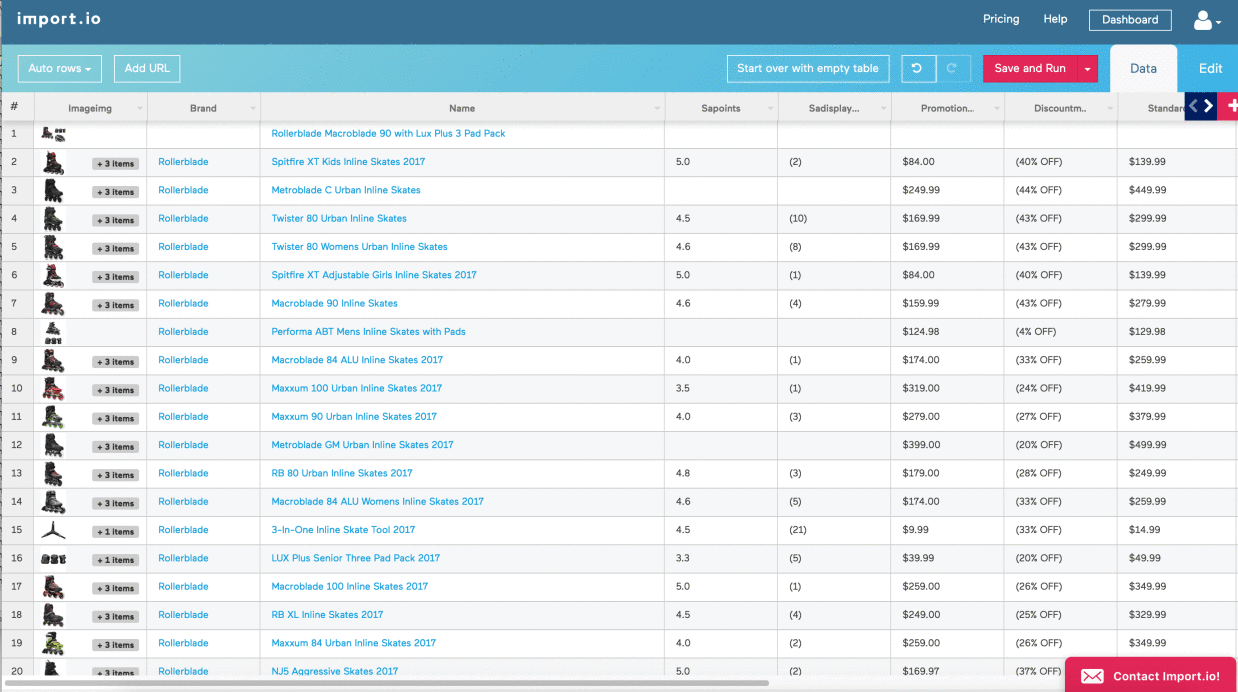

Dallas real estate professionals utilize Zillow data in several ways to enhance their services. They use it to research comparable properties (comps) for accurate pricing strategies, identify market trends, and quickly access property details for clients. For example, an agent might use Zillow to show a client the recent sale prices of similar homes in a specific neighborhood, helping them understand the market value and make informed decisions.

Further, Zillow’s data can inform marketing strategies, allowing agents to target specific demographics and property types effectively. However, it’s crucial to note that agents typically supplement Zillow data with their own expertise, local market knowledge, and access to the Multiple Listing Service (MLS) for a more comprehensive picture.

Comparison of Zillow’s Features with Other Dallas Real Estate Websites

The following table compares Zillow’s key features with those of other popular real estate websites in Dallas:

| Feature | Zillow | Redfin | Realtor.com |

|---|---|---|---|

| Zestimate | Yes | No | No |

| Interactive Maps | Yes | Yes | Yes |

| Detailed Property Information | Yes | Yes | Yes |

| Agent Reviews | Yes | Yes | Yes |

| Mortgage Calculator | Yes | Yes | Yes |

Note: This table reflects common features; specific functionalities may vary over time.

Popular Dallas Neighborhoods on Zillow

Dallas, a vibrant Texas metropolis, offers a diverse range of neighborhoods, each with its unique appeal. Understanding the most popular areas can be crucial for prospective homebuyers navigating the Dallas real estate market. Zillow, a leading online real estate database, provides valuable insights into search trends, reflecting the preferences of home seekers. This section examines the top five most searched Dallas neighborhoods on Zillow, analyzing their characteristics, average home prices, and property taxes.

The popularity of a neighborhood is often a reflection of its amenities, location, and overall lifestyle. Factors like proximity to schools, parks, employment centers, and entertainment venues significantly influence demand. Furthermore, the average home price and property tax rates are key considerations for potential buyers, shaping their purchasing decisions within their budget constraints. Understanding these factors provides a comprehensive view of the Dallas real estate landscape.

Top Five Most Searched Dallas Neighborhoods on Zillow and Their Characteristics

While precise real-time Zillow search data fluctuates, based on recent trends, five neighborhoods consistently rank among the most popular searches. These neighborhoods offer a mix of established communities and newer developments, catering to diverse lifestyles and budgets. Note that average prices and tax rates are subject to change and should be verified with current market data.

| Neighborhood | Average Price (Estimate) | Average Property Tax (Estimate) | Key Features |

|---|---|---|---|

| Highland Park | $2,500,000+ | High (varies significantly based on property value) | Exclusive, upscale community; excellent schools; mature trees; proximity to downtown; luxury amenities. |

| University Park | $1,500,000+ | High (varies significantly based on property value) | Prestigious, family-oriented; top-rated schools; walkable neighborhood; close to Southern Methodist University. |

| Preston Hollow | $1,200,000+ | High (varies significantly based on property value) | Large lots; luxurious homes; quiet residential streets; convenient access to major highways. |

| Lakewood | $750,000+ | Moderate to High (varies based on property value) | Historic charm; walkable; diverse housing styles; vibrant community; proximity to White Rock Lake. |

| Uptown | $600,000+ | Moderate to High (varies based on property value) | Urban living; walkable; trendy restaurants and bars; close to downtown; diverse housing options (condos, townhouses, single-family homes). |

It is important to note that these are estimates based on general market trends and data available from various sources. Actual prices and taxes can vary significantly depending on the specific property, its size, condition, and location within the neighborhood. Consulting a real estate professional for the most up-to-date information is strongly recommended.

Types of Properties Listed on Zillow in Dallas

Zillow offers a diverse range of properties in the Dallas market, catering to a wide spectrum of buyer preferences and budgets. Understanding the distribution of property types is crucial for both buyers seeking specific housing options and real estate professionals analyzing market trends. This section details the various property types available on Zillow in Dallas, providing a comparative analysis of their average prices and a visual representation of their market share.

Find out further about the benefits of funny quotes minion memes funny that can provide significant benefits.

Precise percentage breakdowns fluctuate constantly, so the figures presented below represent a general overview based on recent market data.

Property Type Distribution in the Dallas Zillow Market

The Dallas real estate market showcases a dynamic mix of property types. While single-family homes constitute the largest segment, a significant portion of listings also includes condominiums, townhouses, and other residential options. The following hypothetical breakdown provides a representative distribution, although actual percentages may vary slightly depending on the specific timeframe of data collection. Remember that these are estimates for illustrative purposes only and should not be considered definitive market statistics.

Average Prices of Different Property Types

The average price for each property type significantly varies, reflecting factors such as size, location, amenities, and overall market conditions. For instance, a luxury condo in Uptown Dallas will command a much higher price than a smaller townhouse in a suburban area. The following table illustrates a hypothetical comparison of average prices for these property types. Again, these figures are estimations for illustrative purposes and should be verified with current market data.

| Property Type | Average Price (USD) |

|---|---|

| Single-Family Homes | $450,000 |

| Condominiums | $300,000 |

| Townhouses | $350,000 |

| Multi-Family Homes | $600,000 |

Visual Representation of Property Type Distribution

A bar chart would effectively illustrate the distribution of property types listed on Zillow in Dallas. The horizontal axis would represent the different property types (Single-Family Homes, Condominiums, Townhouses, Multi-Family Homes, and potentially others like land or manufactured homes). The vertical axis would represent the percentage of total listings for each property type. Each property type would be represented by a bar, with the height of the bar corresponding to its percentage share.

For example, if single-family homes constitute 60% of the listings, its bar would be significantly taller than the bars representing condominiums (perhaps 20%), townhouses (15%), and multi-family homes (5%). The chart would clearly show the dominance of single-family homes while highlighting the presence and relative proportions of other property types within the Dallas Zillow market. The visual would reinforce the diversity of housing options available to potential buyers.

Zillow’s Impact on Homebuyers and Sellers in Dallas

Zillow has significantly altered the Dallas real estate landscape, impacting both buyers and sellers. Its readily available data and user-friendly interface have democratized access to property information, but it’s crucial to understand both the advantages and limitations of relying on Zillow throughout the buying and selling process. Navigating this powerful tool effectively can mean the difference between a smooth transaction and a frustrating experience.Zillow’s influence stems from its vast database, encompassing a wide range of properties and providing estimated values (Zestimates).

While this information offers a convenient starting point, it’s essential to remember that Zestimates are not appraisals and should not be considered definitive property valuations.

Advantages and Disadvantages for Dallas Homebuyers Using Zillow

Zillow provides Dallas homebuyers with quick access to a large inventory of properties, allowing them to easily compare listings, filter by criteria (e.g., price range, number of bedrooms), and track price changes. This broad overview aids in identifying potential properties and neighborhoods that align with their needs and budget. However, Zillow’s reliance on automated valuations (Zestimates) can lead to inaccurate pricing, potentially causing buyers to overestimate or underestimate a property’s true value.

Furthermore, the platform doesn’t always reflect the most up-to-date listing information, as some properties might be sold or removed from the market before the Zillow data is updated. Finally, Zillow’s focus on visual presentation might overshadow crucial details only available through professional inspections and disclosures.

Benefits and Drawbacks for Dallas Home Sellers Using Zillow

For Dallas home sellers, Zillow offers a readily available platform to showcase their property to a large audience of potential buyers. The detailed listing options and high-quality photo capabilities can significantly enhance a property’s appeal. Zillow’s data can also help sellers price their property competitively by comparing it to similar properties in the area. However, relying solely on Zillow’s Zestimate for pricing can be detrimental, potentially undervaluing the property and resulting in lost revenue.

Furthermore, Zillow’s fees for enhanced listing features can add up, and the platform’s vast reach can attract a high volume of inquiries, some of which may not be serious buyers.

Zillow’s Data and Negotiation Strategies in Dallas

Zillow’s data, including Zestimates and comparable sales, can significantly inform negotiation strategies for both buyers and sellers. Buyers can leverage Zestimates and comparable sales data to support their offers, particularly if the seller’s asking price appears inflated compared to similar properties. Sellers can utilize Zillow data to justify their asking price, demonstrating the property’s value relative to the market.

However, it’s crucial to remember that Zillow data is only one piece of the puzzle. A professional appraisal, market analysis from a real estate agent, and the specifics of individual properties (condition, upgrades, location) should also factor heavily into negotiation strategies. A buyer might use a low Zestimate to justify a lower offer, while a seller might use recent comparable sales of similar properties to justify a higher offer.

Tips for Effectively Using Zillow in the Dallas Home Buying or Selling Process

Effective use of Zillow requires a balanced approach. It is a valuable tool, but not a replacement for professional advice.

- Verify Zestimate Accuracy: Don’t rely solely on the Zestimate. Consult with a real estate agent for a professional comparative market analysis (CMA).

- Supplement Zillow with Other Resources: Use Zillow in conjunction with other real estate websites and local market knowledge.

- Understand Listing Details: Carefully read all listing details and disclosures; don’t rely solely on photos and descriptions.

- Work with a Real Estate Agent: A qualified agent provides invaluable expertise, navigating the complexities of the Dallas real estate market.

- Consider the Full Picture: Remember that Zillow doesn’t account for factors like property condition, upgrades, or unique features.

Analyzing Zillow Data for Investment Opportunities in Dallas: Zillow Dallas

Zillow provides a wealth of data that can be leveraged to identify promising real estate investment opportunities in Dallas. By analyzing trends in property values, rental rates, and market conditions, investors can make informed decisions about which properties to target and how to maximize their returns. This analysis requires a systematic approach, considering various factors to assess both potential profits and associated risks.

Effective analysis of Zillow data for investment purposes involves a multi-faceted approach. It requires examining not only property prices but also factors such as rental income potential, property taxes, insurance costs, and potential appreciation rates. Furthermore, understanding the broader Dallas real estate market context, including current economic conditions and local development projects, is crucial for making sound investment choices.

By combining Zillow’s readily available data with external market research, investors can significantly improve their decision-making process.

Identifying Potential Investment Opportunities in Dallas Using Zillow Data

Zillow’s data can be used to identify properties with high rental yields, strong appreciation potential, or both. This involves comparing listed prices to recent sales data, analyzing rental rates in the area, and considering the property’s condition and features. For example, a property listed below market value in a rapidly appreciating neighborhood might represent a compelling investment opportunity.

Conversely, a property with high rental income relative to its purchase price could offer strong cash flow potential. Filtering Zillow’s search results by price range, property type, and neighborhood allows for a targeted approach.

Criteria for Selecting Investment Opportunities

Several criteria should guide the selection of investment properties using Zillow data. These include:

- Below-Market Value Properties: Identifying properties listed significantly below the estimated market value, potentially due to urgent sales or overlooked features.

- High Rental Yield: Properties with rental income exceeding the typical return on investment for the area, ensuring a positive cash flow.

- Strong Appreciation Potential: Properties located in neighborhoods with a history of significant property value increases, suggesting future capital gains.

- Favorable Location: Properties situated in desirable neighborhoods with convenient access to amenities, transportation, and employment centers.

- Property Condition: Assessing the property’s condition through Zillow’s photos and descriptions, considering potential renovation costs and their impact on profitability.

Comparing Return on Investment for Different Property Types and Neighborhoods

The potential return on investment (ROI) varies significantly depending on the property type and neighborhood. For example, single-family homes in up-and-coming neighborhoods might offer higher appreciation potential but lower rental yields compared to multi-family properties in established areas. Condominiums can provide a balance, offering lower entry costs and potentially strong rental demand. Zillow’s data allows for a comparative analysis across these categories.

By comparing rental rates, property values, and estimated expenses for different property types within various Dallas neighborhoods, investors can make informed decisions based on their risk tolerance and investment goals. For example, comparing the ROI of a single-family home in Uptown Dallas versus a multi-family property in Oak Cliff provides a concrete example of this analysis.

Assessing Risk and Reward Using Zillow Data

Zillow data helps assess both the potential rewards and risks associated with Dallas real estate investments. The risk assessment involves analyzing factors like market volatility, vacancy rates, and potential maintenance costs. For example, analyzing the historical price fluctuations of properties in a specific neighborhood can provide insights into market stability. Simultaneously, Zillow’s rental estimates and comparable sales data provide a framework for evaluating potential returns.

A comprehensive analysis balances the potential for high returns with the inherent risks of the real estate market. For example, a property in a rapidly developing area may offer high appreciation potential but also carries a higher risk due to market fluctuations.

Understanding the Dallas real estate market through the lens of Zillow offers a powerful tool for both buyers and sellers. By leveraging the data available, informed decisions can be made, leading to more successful transactions. Whether you’re a seasoned investor or a first-time homebuyer, mastering the use of Zillow’s resources can significantly enhance your experience in the competitive Dallas market.

Remember to always consult with real estate professionals for personalized advice and guidance tailored to your specific needs and circumstances.