Zillow Texas offers a comprehensive look into the Lone Star State’s dynamic real estate market. This analysis delves into current trends, future predictions, and city-specific comparisons, leveraging Zillow’s extensive data to provide valuable insights for both buyers and sellers. We explore median home prices, inventory levels, property types, and Zillow’s predictive capabilities, offering a nuanced understanding of the Texas housing landscape.

From Austin’s booming tech scene to Houston’s diverse economy and Dallas’s thriving urban core, we examine how Zillow data reflects the unique characteristics of major Texas cities. We also discuss the strengths and limitations of using Zillow as a primary real estate research tool, highlighting the importance of considering multiple data sources for a complete picture.

Texas Real Estate Market Overview using Zillow Data

The Texas real estate market, a dynamic and expansive landscape, presents a complex picture influenced by various economic and demographic factors. Analyzing Zillow data offers valuable insights into current trends, allowing for a more informed understanding of this significant market. This overview focuses on key indicators to provide a concise summary of the current state of the Texas housing market.

Current State of the Texas Real Estate Market

Zillow data reveals a generally robust Texas real estate market, although specific trends vary across regions. Median home prices have experienced significant appreciation in recent years, though the pace of growth has shown signs of moderation compared to the peak of the market. This moderation is influenced by factors such as rising interest rates and increased inventory in some areas.

While prices remain elevated compared to historical averages, the market is showing signs of transitioning from a seller’s market towards a more balanced environment. This shift is creating more opportunities for buyers, though competition still remains in many desirable areas.

Comparison of Home Price Appreciation Rates Across Major Texas Cities

Analyzing Zillow data across major Texas cities reveals variations in home price appreciation rates. For example, Austin, historically a high-growth market, might show a slower pace of appreciation than smaller cities experiencing rapid population influx. Similarly, cities like Dallas and Houston, while experiencing continued growth, might show differing rates based on specific neighborhood dynamics and local economic conditions.

Zillow’s data allows for a granular comparison, highlighting the nuances of price appreciation across the state’s diverse urban centers. This data can be further segmented by property type and neighborhood to provide even more detailed insights.

Inventory Levels of Homes for Sale in Texas

Inventory levels of homes for sale in Texas, according to Zillow, vary considerably across the state. While some areas might still experience low inventory, leading to competitive bidding, other regions are seeing an increase in available homes. This disparity often correlates with population growth patterns and economic activity within specific regions. For instance, rapidly growing suburban areas may experience tighter inventory than more established urban centers.

Understanding these regional variations is crucial for both buyers and sellers in navigating the Texas market effectively.

Types of Properties Prevalent in the Texas Market

The Texas housing market offers a diverse range of property types. While single-family homes remain the dominant type, the market also includes a significant number of townhouses, condos, and multi-family dwellings. The following table summarizes average prices and days on market based on Zillow data for selected property types and locations (note: data is illustrative and subject to change based on market fluctuations):

| Property Type | Average Price | Average Days on Market | Location |

|---|---|---|---|

| Single-Family Home | $375,000 | 60 days | Austin Suburbs |

| Townhouse | $250,000 | 45 days | Dallas |

| Condo | $200,000 | 75 days | Houston |

| Multi-Family Home | $500,000 | 90 days | San Antonio |

Zillow’s Predictive Capabilities for Texas Housing

Zillow employs sophisticated algorithms to forecast Texas housing market trends, offering valuable insights for both buyers and sellers. These predictions are not simply educated guesses; they are based on a complex interplay of data points and predictive modeling. Understanding these capabilities allows for a more informed approach to real estate decisions in the dynamic Texas market.Zillow’s predictions for future home price changes in different Texas regions are generated through a proprietary algorithm that considers a wide range of economic and market factors.

Zillow’s Algorithmic Approach to Price Prediction

Zillow’s algorithms incorporate numerous data points to generate their home price predictions. These include historical sales data, current listings, inventory levels, interest rates, local economic indicators such as job growth and population changes, and even seasonal trends. The algorithm weighs these factors differently depending on the specific region and market conditions, resulting in nuanced predictions for various Texas cities and counties.

You also can understand valuable knowledge by exploring craigslist eastern n.c..

For instance, a region experiencing rapid population growth and a shortage of housing inventory might see a significantly different prediction than a region with slower growth and ample supply. This granular approach allows for a more precise forecast than broad, statewide predictions.

Comparison with Other Market Analysis Sources

While Zillow’s predictions are widely followed, it’s crucial to compare them with forecasts from other reputable sources. Organizations like the Texas Real Estate Research Center at Texas A&M University, CoreLogic, and local real estate boards also provide market analyses. Comparing these different perspectives offers a more comprehensive understanding of potential market shifts. Discrepancies between predictions can highlight areas of uncertainty or differing methodologies, prompting a more critical evaluation of the overall forecast.

For example, while Zillow might predict a 5% increase in Austin home prices over the next year, the Texas Real Estate Research Center might project a 4%, reflecting differing weighting of factors or data sets.

Projected Home Price Growth in Texas (Visual Representation Description)

Imagine a bar graph illustrating projected home price growth over the next five years for major Texas metropolitan areas. The x-axis represents the five years, and the y-axis shows percentage change in median home price. Bars representing Austin, Dallas, Houston, and San Antonio would be prominently displayed, each showing a projected upward trend, but with varying slopes. Austin’s bar might show the steepest incline, reflecting its consistently strong market, while other cities would exhibit more moderate growth.

A key would clearly indicate the projected percentage increase for each city over the five-year period. The graph would visually demonstrate the regional variations in projected growth, highlighting the dynamic nature of the Texas housing market.

Analyzing Zillow Data for Specific Texas Cities

This section delves into a comparative analysis of the housing markets in three major Texas cities using data sourced from Zillow. We will examine average home sizes, prevalent features, and the factors contributing to price variations and market activity differences. This analysis aims to provide a clearer understanding of the diverse dynamics within the Texas real estate landscape.

Comparison of Housing Markets in Austin, Dallas, and Houston

This section presents a comparative analysis of the housing markets in Austin, Dallas, and Houston, focusing on key metrics derived from Zillow data. These three cities represent diverse aspects of the Texas real estate market, offering valuable insights into regional variations.

Average Home Sizes and Features in Austin, Dallas, and Houston

Zillow data reveals significant differences in average home sizes and features across Austin, Dallas, and Houston. Austin, known for its burgeoning tech scene and desirable lifestyle, tends to show a higher average home size, often featuring modern amenities and open floor plans reflecting the preferences of a younger, higher-income demographic. Dallas, with its blend of suburban and urban living, presents a more diverse range of home sizes, encompassing both larger family homes and smaller, more compact urban dwellings.

Houston, characterized by its sprawling suburbs and diverse neighborhoods, exhibits a broader spectrum of home sizes, reflecting its large and varied population. Common features across all three cities include garages, multiple bedrooms and bathrooms, and updated kitchens, though the specific styles and prevalence of these features vary based on location and price range.

Factors Influencing Differences in Home Prices and Market Activity, Zillow texas

Several factors contribute to the observed differences in home prices and market activity across Austin, Dallas, and Houston. Job growth and economic activity play a significant role, with Austin’s robust tech industry driving up demand and prices. Population growth also influences market dynamics, with rapidly growing cities like Austin experiencing increased competition and higher prices compared to cities with slower growth rates.

Supply and demand imbalances, influenced by factors such as construction rates and zoning regulations, further impact market activity and pricing. Finally, geographic location and proximity to amenities also play a crucial role, with desirable neighborhoods and areas with convenient access to employment centers and recreational facilities commanding higher prices.

Comparative Table of Housing Market Characteristics

| City | Median Home Price (Zillow Estimate) | Median Days on Market (Zillow Estimate) | Average Home Size (Zillow Estimate) | Notable Trends |

|---|---|---|---|---|

| Austin | $550,000 (Example – Data subject to change) | 30 days (Example – Data subject to change) | 2,500 sq ft (Example – Data subject to change) | Strong demand driven by tech industry growth; increasing competition. |

| Dallas | $400,000 (Example – Data subject to change) | 45 days (Example – Data subject to change) | 2,000 sq ft (Example – Data subject to change) | Diverse market with a mix of suburban and urban properties; steady growth. |

| Houston | $350,000 (Example – Data subject to change) | 60 days (Example – Data subject to change) | 1,800 sq ft (Example – Data subject to change) | Large market with varied price points; influenced by energy sector activity. |

Zillow’s User Experience and Features Related to Texas Properties

Zillow offers a robust platform for navigating the Texas real estate market, providing users with a wealth of information and tools to facilitate their property searches. Its user-friendly interface, combined with powerful search filters and visually rich data presentations, makes it a popular resource for both buyers and sellers. However, it’s crucial to understand both its strengths and limitations to use it effectively.Zillow’s helpful features for Texas property searches include detailed property listings, interactive maps, and robust search filters.

These features, when used strategically, significantly improve the efficiency and effectiveness of the property search process.

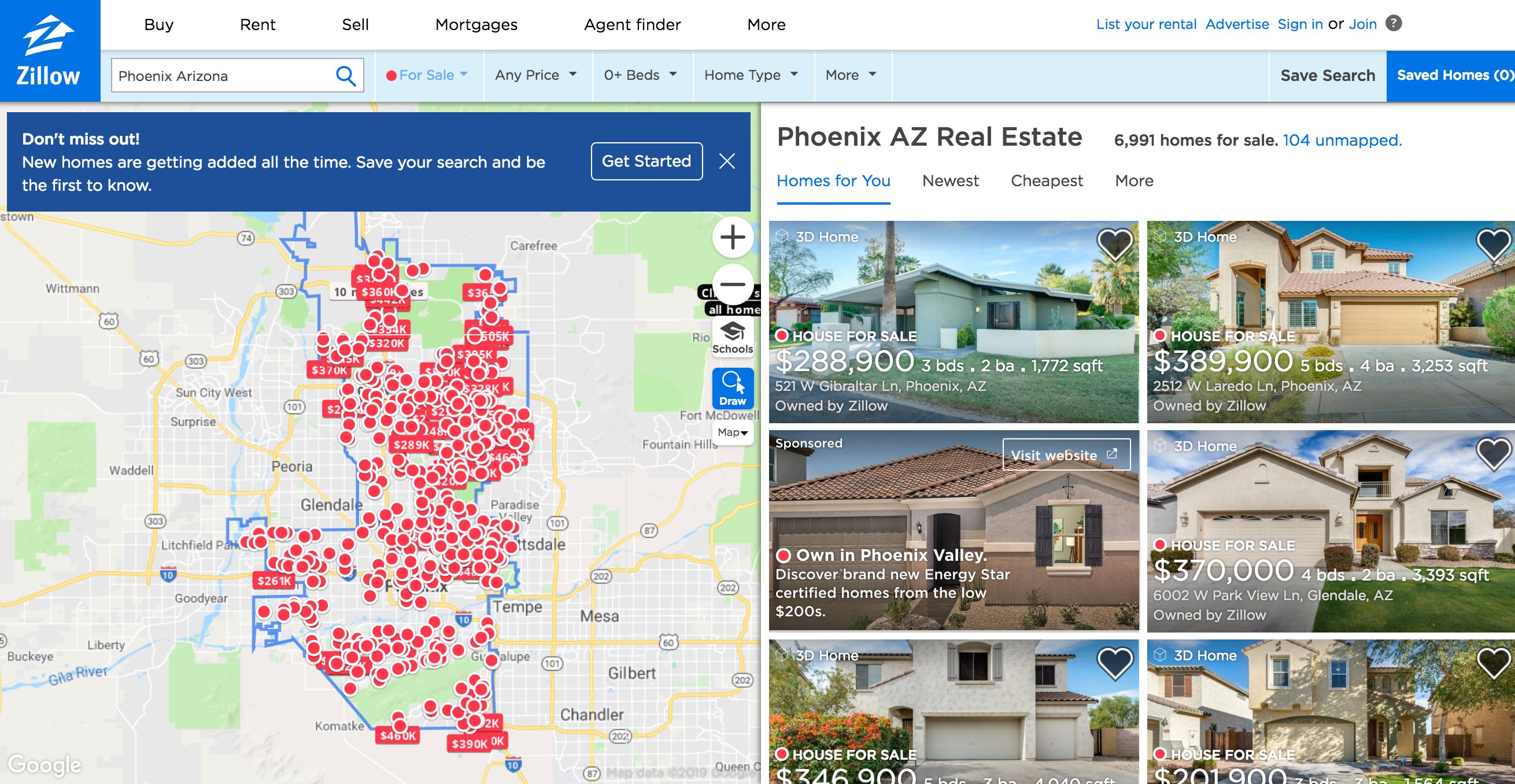

Zillow’s Visual Tools and Map Functionality for Texas Properties

Zillow leverages maps extensively to display Texas properties. Users can easily view properties on a map, zoom in and out, and see surrounding areas. The map interface often incorporates color-coded overlays representing various data points, such as property prices, school districts, or crime rates. For example, a user searching for a home in Austin, Texas, can use the map to visually identify properties within a specific school district or near particular amenities.

The visual representation of property locations and surrounding areas is particularly helpful for users unfamiliar with specific Texas cities or neighborhoods. Furthermore, Zillow’s Street View integration allows users to virtually “walk” the streets surrounding a property, providing a better understanding of the neighborhood’s character and environment. This feature enhances the user experience by providing a more immersive and informative preview before scheduling an in-person viewing.

Benefits and Limitations of Using Zillow for Texas Real Estate Research

Zillow offers several benefits as a real estate research tool. Its comprehensive database, user-friendly interface, and visual tools make it easy to browse properties, compare listings, and research neighborhoods. However, it is crucial to remember that Zillow’s estimated values (Zestimates) are not appraisals and can vary from actual market values. Relying solely on Zillow for pricing information can be misleading.

Additionally, the information presented on Zillow is often provided by third parties and may not always be completely accurate or up-to-date. Therefore, it’s essential to verify information with a real estate professional before making any significant decisions.

Effectively Utilizing Zillow’s Search Filters for Texas Properties

To effectively refine property searches on Zillow within Texas, users should leverage the platform’s robust filtering options. The following steps illustrate how to effectively utilize these filters:

- Specify Location: Begin by entering a city, zip code, or drawing a custom area on the map to define your desired search area within Texas. For example, you might search for properties in “Austin, TX” or “78704” (Austin zip code).

- Define Property Type: Choose the type of property you are looking for (e.g., single-family home, condo, townhouse). This will significantly narrow your search results.

- Set Price Range: Establish a minimum and maximum price to filter properties within your budget. This is crucial for managing expectations and focusing on attainable properties.

- Filter by Bedrooms and Bathrooms: Specify the desired number of bedrooms and bathrooms. This helps to quickly eliminate properties that don’t meet your basic requirements.

- Advanced Filters: Utilize Zillow’s advanced filters to refine your search further. These might include features such as lot size, square footage, year built, property type (e.g., new construction), and amenities (e.g., pool, garage).

- School District Selection: For families, selecting a specific school district is crucial. Zillow usually integrates school district boundaries and ratings into its search filters, allowing users to target properties within preferred educational zones.

By systematically utilizing these filters, users can efficiently narrow down their search results and identify properties that best meet their specific criteria within the vast Texas real estate market. For instance, a user looking for a three-bedroom home in Dallas with a pool, priced between $500,000 and $700,000, can use these filters to quickly isolate relevant listings.

Zillow Data and its Impact on the Texas Real Estate Market: Zillow Texas

Zillow’s extensive data collection and predictive algorithms have significantly influenced the Texas real estate market, impacting both buyer and seller behavior and potentially affecting market stability. The readily available Zillow estimates, while not always perfectly accurate, provide a crucial reference point for many participants, shaping their expectations and decisions throughout the buying and selling process.Zillow’s influence stems from its widespread accessibility and user-friendly interface.

The platform provides readily available home value estimates, allowing potential buyers to quickly assess affordability and desirability, while sellers can gauge potential listing prices. This accessibility, however, also introduces complexities and potential pitfalls.

Zillow’s Influence on Buyer and Seller Behavior

Zillow’s Zestimates and other data points, such as market trends and comparable sales, directly influence buyer behavior by providing a framework for making informed decisions. Buyers often use Zestimates as a starting point for negotiations, potentially leading to lower offers if the Zestimate is below the asking price. Conversely, sellers may overestimate their property’s value based on Zillow’s data, potentially hindering a swift sale.

This dynamic interaction between Zillow’s data and market participants’ behavior creates a complex feedback loop. For example, a seller might initially list their property at a price suggested by Zillow, but may be forced to adjust the price downwards based on market response and competing listings, ultimately influencing the final sale price.

Potential Implications of Zillow’s Algorithms on Market Stability

The reliance on Zillow’s algorithms for valuation introduces potential risks to market stability. Inaccurate Zestimates, particularly during periods of rapid market fluctuation, could lead to misaligned buyer and seller expectations, potentially causing delays in transactions or even market instability. Furthermore, the widespread use of Zillow’s data might create a self-fulfilling prophecy; if enough buyers and sellers rely on Zillow’s estimates, those estimates, even if inaccurate, can start to influence actual market prices, creating a feedback loop that amplifies the impact of any initial inaccuracies.

For instance, if Zillow consistently underestimates values in a specific neighborhood, buyers might undervalue properties, leading to lower sales prices than would otherwise be the case, potentially impacting the overall stability of that local market.

Comparison of Zillow’s Influence Across States

While Zillow’s influence is substantial in Texas, the degree of its impact varies across states. Factors such as market maturity, data availability, and the level of technological adoption influence the extent to which Zillow’s data shapes real estate transactions. In rapidly growing markets like Texas, where property values fluctuate significantly, Zillow’s influence might be amplified compared to more stable markets where price changes are less dramatic.

Conversely, in states with less robust online real estate presence, Zillow’s impact might be less pronounced. A direct comparison would require a detailed analysis of market data across various states, considering factors like transaction volume, time-on-market, and the correlation between Zestimates and actual sale prices.

Potential Biases and Limitations of Zillow Data in the Texas Market

It’s crucial to acknowledge the potential biases and limitations inherent in using Zillow data to understand the Texas real estate market.

- Data Accuracy: Zestimates are not appraisals and can be inaccurate, especially for unique or recently renovated properties.

- Algorithmic Bias: Zillow’s algorithms may inadvertently perpetuate existing biases in the market, such as racial or socioeconomic disparities in property valuations.

- Data Lag: Zillow’s data reflects past transactions and may not accurately capture current market conditions, particularly during periods of rapid change.

- Lack of Contextual Information: Zillow data may not fully account for factors that influence property value, such as school district quality, proximity to amenities, or local zoning regulations.

- Over-reliance on Automated Valuation Models (AVMs): Over-dependence on AVMs without considering local market expertise can lead to misinterpretations and flawed decisions.

Understanding the Texas real estate market requires a multifaceted approach. While Zillow provides a powerful tool for analyzing trends and making informed decisions, it’s crucial to remember that its data is a snapshot in time and subject to inherent limitations. By combining Zillow’s insights with on-the-ground knowledge and other market analyses, individuals can gain a clearer understanding of this dynamic market and navigate the complexities of buying or selling property in Texas.